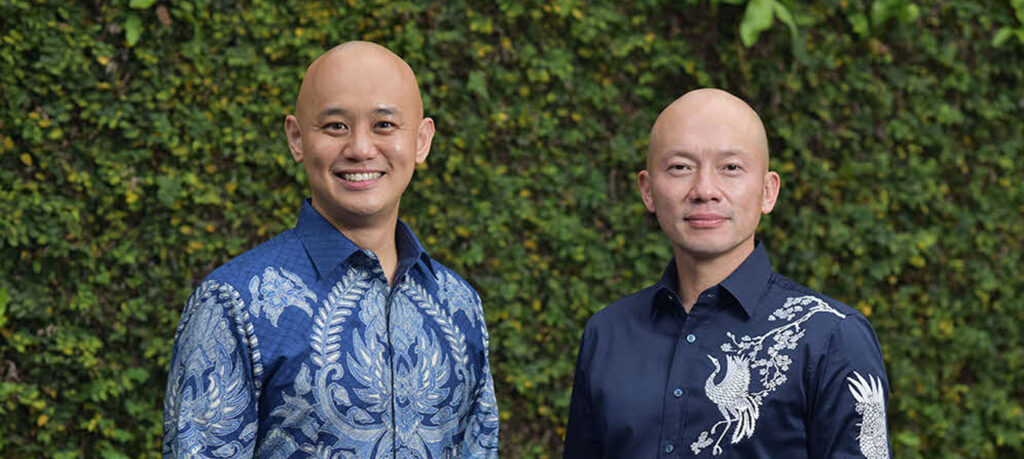

Damian Payiatakis, our Head of Sustainable and Impact Investing, sat down with Kimin Tanoto and Kelvin Fu of Gunung Capital, following the transformation of the family’s structural steel business and subsequent sale in June 2024, which valued the business at $450 million.

Renewables are a compelling opportunity, but the ‘greening’ of carbon-intensive sectors such as steel production also offers attractive returns in the region, according to Kelvin Fu, managing partner of the Singapore-based private investment management firm Gunung Capital.

In a significant move signalling a new phase of growth and expansion, PT Gunung Raja Paksi Tbk (GRP) and its affiliated company, PT Gunung Garuda (GRD), announced the completion of the sale process involving a combined 95% stake in its subsidiary, PT Nusantara Baja Profil (NBP), to Yamato Kogyo Corporation (YKC), Siam Yamato Steel (SYS), and Hanwa Indonesia (HWI), a subsidiary of Hanwa Co Ltd, as agreed upon in definitive agreements executed on 8 August 2023.

The founding family of Indonesian steel producer, Gunung Raja Paksi, shares with CNBC’s Sri Jegarajah why the company moved from a family structure to a professional-management style.

With carbon border taxes making life harder for carbon-intensive industries, Gunung Raja Paksi feared it could not export its products to the West if it did not slash emissions. The firm’s top executives Kimin Tanoto and Kelvin Fu tell Eco-Business about how a firm in the hardest-to-abate sector is reducing its carbon footprint.

Singapore plans to dramatically increase the tax it levies on greenhouse gas pollution from its biggest emitters from 2024, as the city-state seeks to speed efforts to reach net-zero emissions.

Gunung Capital has partnered with Yayasan Habitat Kemanusian Indonesia to build and operate a new Posyandu building that will deliver healthcare services.

Kelvin Fu, Managing Partner at Gunung Capital, said: “This purchase of carbon credits marks an important milestone in our commitment to encouraging the adoption of decarbonisation technology and related innovation, establishing carbon credits as a recognised emerging asset class, and ultimately funnelling more capital into sustainable enterprises. We look forward to partnering with more global investors, institutions, policy makers, and non-governmental organizations in future.”

Singapore-based asset management firm Gunung Capital is looking to invest up to $500 million in the coming years to reduce the carbon footprint of the industrial and manufacturing businesses under its management.

The firm told the Straits Times that it also plans to help other smaller companies involved in manufacturing or production move towards net-zero emissions.

Kimin Tanoto, Founder and CEO of Gunung Capital and heir to the Tanoto business dynasty, and Kelvin Fu, Managing Partner of Gunung Capital, share their vision and understanding in bringing the environment to the forefront of business decisions.

Creating and nurturing investments that have a meaningful impact on society and the environment is a new year’s resolution that more investors will be making as the world comes together to achieve net-zero.