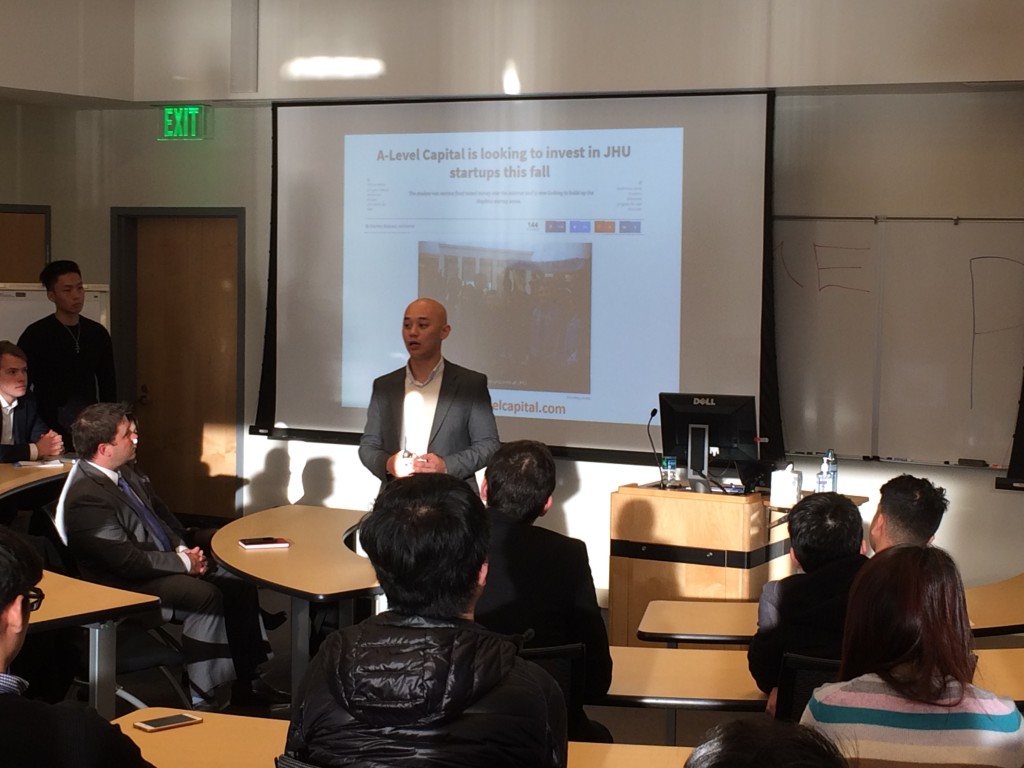

The Private Equity and Venture Capital Club (PEVC) at Johns Hopkins held its kick-off meeting of the 2015-2016 academic year on Oct 19, 2015. Students and faculty members alike eagerly attended Monday’s meeting to learn more about the club’s future as well as the private equity industry as a whole. PVEC was founded in 2015 by Kelvin Fu and his peers during his tenure at Johns Hopkins. As an alumni of the school and club, he continues to be involved with the club’s events and leadership today.

PEVC aims to create industry exposure among a wide array of students through professional development, education, and experiential learning. PEVC is working hard to secure a compelling speaker series that features industry leaders that carry a breadth of knowledge and experience to share. Chris Hoehn-Saric of Sterling Partners and Shane Kim of Camden Partners are scheduled to speak in November. In addition to speaker series, the club plans to promote education through a variety of courses including financial modeling and leverage buyouts.

Connecting interested JHU students to the private equity and venture capital industry

Professional development opportunities come in the form of networking events, employer treks, and journal publications. PEVC is also excited to announce the Venture Capital Investment Competition (VCIC) which will allow students to gain exposure to the investment process and network and build strong strong connections with fellow competitors and team members. The Hopkins internal event will be held on November 21st at the Carey Business School and the winner will advance to the mid-Atlantic regional event.

With how competitive and fast-paced the private equity and venture capital sectors are, the PVEC is a useful way for entrepreneurial JHU students to build up their network of connections. PVEC