Cost optimization is an important strategy for private equity firms to maximize returns for their investors. With the increasing focus on cost reduction, private equity firms are looking for ways to optimize their costs and achieve higher profits.

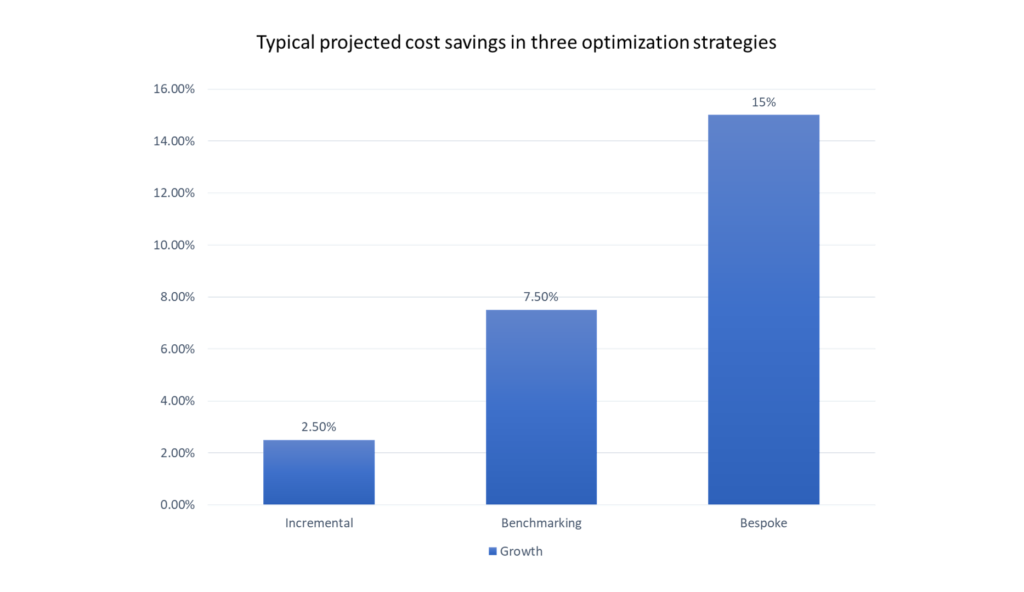

To successfully deliver cost optimization strategies, businesses need to understand their real cost drivers, determine what the sustainable cost should be, and have the right competencies and mindset to rapidly deliver cost savings. According to EY, leaders usually decide on the scope, intensity and timing with one of three common approaches to cost optimization strategy.

- The incremental approach, which includes budget cuts and the adoption of lean methods. This approach is frequently employed to balance pressures in a low-inflation environment, although it only provides a few percentage points of cost optimization at best.

- The benchmarking approach involves comparing a company to its peers in order to identify cost-cutting opportunities.” This method may result in 5- 10% incremental savings, but it risks being a band-aid solution that does not fully leverage greater efficiencies within the organization. With this approach, broader company buy-in may also be an issue.

- The bespoke approach, which is business-driven and focuses on key value drivers, can lead to the best results, with potential improvements in margins of more than 15%. Collaboration is often required throughout the process and can lead to better internal acceptance.

Source: EY

Conduct a thorough cost analysis

Before implementing any cost optimization strategy, it is important to conduct a thorough cost analysis. This involves identifying all the costs associated with the business, including direct and indirect costs, and understanding where the costs are being incurred. By conducting a cost analysis, private equity firms can identify areas where costs can be reduced and develop a cost optimization strategy.

Private equity firms can also achieve cost optimization by reducing overhead costs. This can be achieved by reducing office space, cutting back on travel expenses, and implementing remote working policies. By reducing overhead costs, private equity firms can reduce costs and achieve higher profits.

Increase efficiency measures and streamlined process

One of the most effective ways to achieve cost optimization is by improving operational efficiency by implementing lean management practices, optimizing production processes, and reducing waste.

Streamlining processes can also help to reduce costs. This involves identifying and eliminating bottlenecks in the production process, reducing the number of steps involved in a process, and improving the flow of information within the organization. This method can help the PE firms to increase efficiency and reach maximum potential for the company.

Optimize the supply chain

Supply chain is critical to the business process. Optimizing the supply chain can help to reduce costs by improving the efficiency of the procurement and logistics processes. It can be done by negotiating better prices with suppliers, implementing just-in-time inventory management systems, and improving the visibility of the supply chain.

Technology and AI is a game changer

Cost optimization should be considered from a transformational perspective, focusing on changing processes and driving efficiencies through continuous improvements. Automation is critical for a robust forecasting process, allowing a business to quickly react to change and making its cost optimization strategy more agile. Rather than focusing solely on cost-cutting, the goal should be to create long-term value for the business.

Implementing technology can help to reduce costs by automating processes and improving efficiency. Implementing enterprise resource planning (ERP) systems, adopting cloud-based solutions, and implementing artificial intelligence (AI) and machine learning (ML) technologies.

Monitor and measure cost savings

It is important to monitor and measure the cost savings achieved through cost optimization strategies. By monitoring and measuring cost savings, private equity firms can identify areas where further cost savings can be achieved and optimize their cost optimization strategies accordingly.

In conclusion, cost optimization is an important strategy for private equity firms to maximize returns for their investors and achieve significant cost savings. The current business environment is challenging due to various factors like inflation, supply chain disruption, and talent shortages. Traditional approaches to cost reduction offer only short-term benefits. Private equity firms need to adopt a holistic approach and collaborate with different teams to achieve sustainable value.