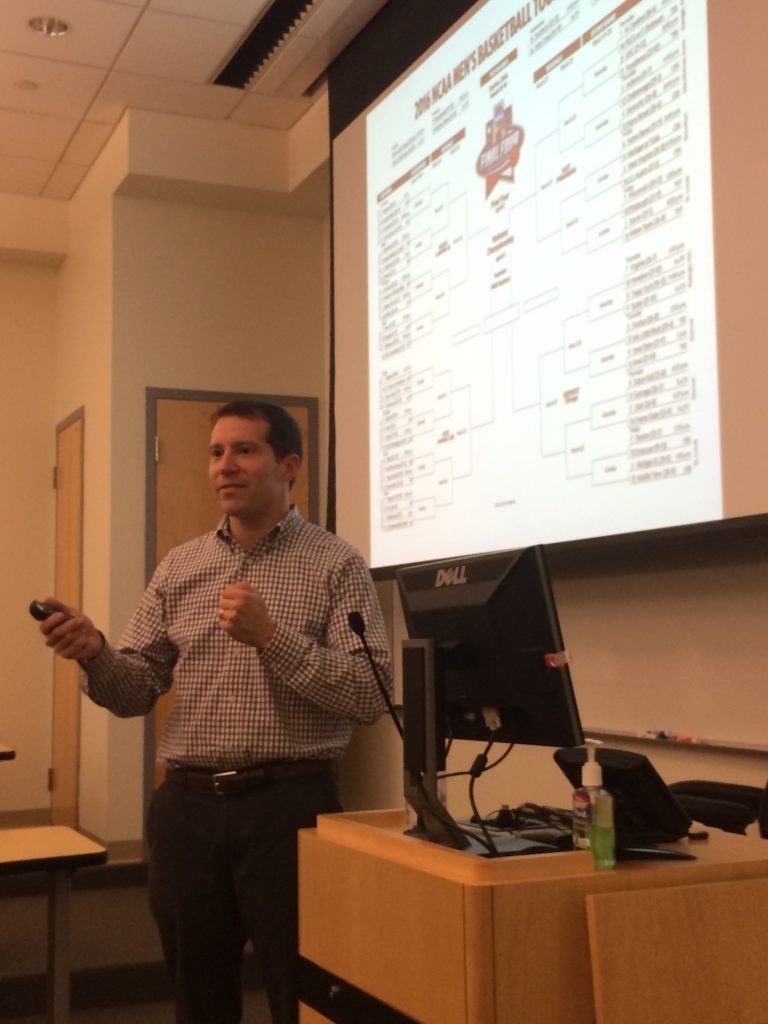

We hear a lot about venture capital and the tremendous returns they produce, but what exactly do venture capitalists do? To help demystify the profession, the Johns Hopkins Private Equity and Venture Capital Club held a keynote with Nick Superina, Partner at Baltimore-based QuestMark Partners. With close to US$1 billion under management, the majority of the expansion-stage venture capital firm interests lie in the realm of technology and healthcare. Our topic was titled “Behind the Scenes of a Venture Capitalist” and it was held at the Carey Business School on Apr 27, 2016.

Learning More About Venture Capitalists

The term “venture capital” refers to investments in private, mostly earlier-stage companies with the potential for rapid growth and value creation. Nick described the structure and economics of a venture capital firm and the value-add that they bring in terms of experience, connections, access to further capital and credibility. Oftentimes, a startup has to navigate the different stages of financing – starting with seed capital and moving towards the alphabetical soup of series funding. With different investors that focus on different stages of funding, there has been a blurring of investment stages as venture capital firms expand their fund offerings and focus. QuestMark focuses on the expansion stage financing (Series C/D) where the business model has been proven, the management team has been established and there is a need for capital to execute the market expansion strategy.

The Venture Capitalists of Today

One of the most recent blockbuster exits for QuestMark Partners was Virtustream, industry leader and innovator for running mission-critical enterprise applications via cloud computing. QuestMark’s initial investment in Virtustream was in 2012, and the company was acquired by EMC in May 2015 for US$1 billion.

Nick shared that the decision-making process in venture capital is as much an art as it is a science. Most venture capitalists employ a robust and standardised due diligence process, in conjunction to relying to a significant extent on their gut and experience. Companies that seem to be a sure-win today might not seem as great compared to when they were first evaluated. Inevitably, venture capitalists sometimes miss great opportunities and QuestMark is no exception to the rule.

Nick walked the floor through several case studies on investments QuestMark Partners had made and passed previously, challenging the audience to exercise their judgement on whether or not they would invest in a selection of portfolio companies. In addition, a valuation exercise was conducted and Nick further discussed how a company’s worth is routinely framed as a multiple of its revenue or profitability. Adding on as a caveat, Nick was also quick to point out that venture valuations are often not tied to current operating numbers.

Becoming a Venture Capitalist

Lastly, Nick shared some of the possible paths to becoming a venture capitalist. The common paths denoted were through investment banking, consulting and business school, but noted that there has been an increasing demand in the profession to have individuals possessing subject matter expertise in their own fields. Other alternative paths into venture capital include working at a corporate venture capital such as General Electric and Intel and working at the commercialisation office of a University such as Johns Hopkins Technology Ventures.